HRM Council is currently working through the budget for 2021/22. This budget will be developed through the end of April 2021, and will be ratified by HRM Council in May 2021. The schedule of budget meetings is below.

I plan to document this process as we go through it, including some of the more challenging decisions that we make.

Contents:

- Budget Meeting Schedule

- 2020/21 Budget

- Fiscal Framework – the starting point

- 2021/22 Operating Budget as it develops

- Budget Adjustment List (Overs and Unders)

Budget Meeting Schedule

You can find the full schedule of our meetings here. The agenda and supporting information, for each meeting, is put on the web site a few days in advance of the meeting. Any meetings that don’t have the agenda posted will redirect back to the schedule page.

- Dec 1 – 2021/25 Strategic Priority Framework and Multi-Year Strategic Planning and Budget Process – Agenda and Report

- Dec 15 – Fiscal Sustainability Strategy – Agenda and Report

- Jan 12 – 2021-2025 Strategic Priorities Plan (Council Priorities) and Advance Tenders – Agenda, Reports, and Presentation

- Jan 13 – 2021/22 Fiscal Framework – Agenda, Report, and Presentation – Details

- Jan 20 – Strategic Initiative Funding Report – Agenda and Report

- Feb 3 – CAO, HR, Legal, and Auditor General budgets – Agenda and Reports

- Feb 5 – Budget Options (continuation of Feb 3)

- Feb 10 – Fiscal Services, Finance and ICT, and Corporate and Customer Services budgets – Agenda and Reports

- Feb 17 – Police and Library budgets – Agenda and Reports

- Feb 24 – Capital Budget Recommendation (Reserve Withdrawals, Multi-Year Projects) – Agenda and Reports

- Mar 3 – Fire budget – Agenda and Reports

- Mar 10 – Transit budget – Agenda and Reports

- Mar 24 – Transportation and Public Works budget – Agenda and Reports

- Mar 31 – Parks & Recreation budget – Agenda and Reports

- Apr 7 – Planning & Development budget – Agenda and Reports

- Apr 20 – Budget Adjustment List (BAL) review – Agenda and Report

- May 4 – 2021/22 Budget and Business Plan Approval by Council

Public Participation

We have room for public participation at most budget meetings. If you would like to speak to Council at the budget meeting then you need to register with the clerks office by 4:30pm on the day before the meeting. You can contact the clerks office by e-mailing clerks@halifax.ca or by phoning them at 902-490-4210 (Mon-Fri, 8:30am-4:30pm).

2020/21 Budget

In 2020 we worked through two budgets. We had the first one complete and then COVID hit so we had to start over. I’m including information from the first budget to put the rest of it in context.

HRM Revenue by category

This table shows where HRM gets its funds and is based on the budget documents that are located here: https://www.halifax.ca/city-hall/budget-finances/budget

| Revenue ($ thousands) | 2019/20 | 2020/21 | $ change |

|---|---|---|---|

| Residential Taxes | 259,300 | 267,700 | 8,400 |

| Commercial Taxes | 234,100 | 238,100 | 4,000 |

| Payment in Lieu of Taxes | 41,600 | 39,400 | (2,200) |

| Deed Transfer Tax | 39,000 | 40,900 | 1,900 |

| Transit Fares | 35,200 | 16,500 | (18,700) |

| Area Rate Revenues | 235,700 | 244,300 | 8,600 |

| Fee Revenue | 41,800 | 44,600 | 2,800 |

| Other | 69,000 | 63,800 | (5,200) |

| Total Revenue | 955,700 | 955,300 | (400) |

HRM Expenses by department

This table shows how much each department was budgeted for in the 2020/21 fiscal year.

| Expenses, by department ($ thousands) | Compensation | Other | Total |

|---|---|---|---|

| CAO | 5,026 | 5,825 | 10,850 |

| HR | 6,666 | 868 | 7,534 |

| Legal | 7,272 | 1,398 | 8,670 |

| Auditor General | 1,032 | 95 | 1,127 |

| Fiscal Services | 15,098 | 343,902 | 359,000 |

| Finance / ICT | 27,558 | 21,531 | 49,089 |

| CCS | 19,089 | 23,313 | 42,402 |

| RCMP | 27,480 | 27,480 | |

| HRP | 93,141 | 7,197 | 100,338 |

| Library | 20,922 | 7,631 | 28,552 |

| Fire | 71,252 | 3,617 | 74,869 |

| Transit | 84,818 | 33,010 | 117,828 |

| TPW | 25,483 | 80,548 | 106,030 |

| Parks | 25,798 | 18,897 | 44,695 |

| Planning | 12,260 | 9,909 | 22,169 |

| Total | 415,415 | 585,218 | 1,000,633 |

HRM Capital Expenses by type

Within the expenses, above, are about $200M in Capital expenses. This table shows the type of expenses. This is broken down by type of expense, which does not map to the departments listed above.

| Capital, by expense type ($ thousands) | |

|---|---|

| Buildings / Facilities | 45,145 |

| Business Systems | 20,085 |

| District Capital Funds | 1,504 |

| Outdoor Recreation | 6,240 |

| Roads / AT / Bridges | 65,740 |

| Traffic / Street lights | 2,570 |

| Vehicles / Vessels / Equipment | 36,330 |

| Other Assets | 2,210 |

| Total | 179,824 |

Fiscal Framework – the starting point

The Fiscal Framework presentation, on Jan 13, showed us a broad picture of the finances across the past number of years as well as some projections for future years.

This presentation also allows us to set the starting point for the budget. Included in the meeting was a motion to increase the average property tax bill by 1.9% and set an area rate of $0.341 per $100 for the mandatory provincial contributions. Staff has taken this direction and will be creating a suggested budget based on that. Council will examine that suggested budget in detail and comment on many of the items in it. We may increase or remove some, or add or delete some. That will all have an impact on the average property tax bill change.

Your property tax bill is made up of the assessment of your property multiplied by the tax rate. Staff are asking for an increase in your tax bill. If the assessment goes up enough to cover the increase in the bill then the tax rate can go down. This is the starting point, as shown in the table below for the residential taxes.

This shows that the average residential tax bill will change from $2,015 to $2,053, which is an increase of $38 or 1.9%, for the year. This is due to a very minor increase in the tax rate.

| Residential | 2020/21 | 2021/22 | 2021/22 |

|---|---|---|---|

| Assessment | $247,200 | $250,400 | $250,400 |

| Tax Rate | 0.815% | 0.815% | 0.820% |

| Tax Bill | $2,015 | $2,041 | $2,053 |

| What Changed | Assessment | Tax Rate | |

| How Much % | 1.2% | 0.6% | |

| How Much $ | $26 | $8 |

And for commercial taxes this shows that the average tax bill will change from $42,834 to $43,651, which is is an increase of $817, or 1.9%, for the year. This is due to a reduction in the tax rate.

| Commercial | 2020/21 | 2021/22 | 2021/22 |

|---|---|---|---|

| Assessment | $1,427,800 | $1,465,300 | $1,465,300 |

| Tax Rate | 3.000% | 3.000% | 2.979% |

| Tax Bill | $42,834 | $43,959 | $43,651 |

| What Changed | Assessment | Tax Rate | |

| How Much % | 2.6% | -0.7% | |

| How Much $ | $1,125 | $-308 |

The other part of the motion from staff asked to set an area rate of $0.341 per $100 of the assessment. These contributions are required by the province to cover:

- Mandatory Education: This mandatory education contribution is set by the Province at the value of the Provincial Education Rate times the Uniform Assessment.

- Property Valuation Services Corporation (PVSC): is mandated under the Nova Scotia Assessment Act to assess every property in Nova Scotia. HRM is required to pay to help fund this independent agency. The contribution amount is set by Provincial formula based on Uniform Assessment and the number of assessment accounts in each municipality.

- Correctional Services: HRM is required to make a mandatory contribution to the Province to fund the cost of correctional services. The contribution amount is set by provincial formula based on Uniform Assessment and the number of dwelling units in each municipality.

- Housing: HRM is required to pay a portion of the Metropolitan Regional Housing Authority operating deficit each year.

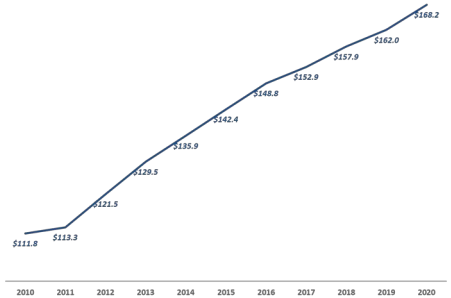

Since 2010 the amount of this contribution has risen by more than $56 million, an average of 4.5% annually. This increase is mandated by the province.

You can find more information about the tax rates, on your tax bill, here.

2021/22 Operating Budget as it develops

Through early April we will be receiving reports from the different business units about how their budgets will be shaping up.

This table will show the operating budget as we receive requests from each department.

| 2020/21 staff | 2021/22 request | 2021/22 staff | 2020/21 budget | 2020/21 projection | 2021/22 request | % change | 2021/22 budget | Links | |

|---|---|---|---|---|---|---|---|---|---|

| CAO | 34.3 | 14.0 | 48.3 | $8,134,800 | $8,255,200 | $1,739,900 | 21.4 | $9,874,700 | report |

| HR | 64.0 | 1.0 | 65.0 | 6,370,800 | 6,426,579 | 799,200 | 12.5 | 7,170,000 | report |

| Legal | 72.7 | 2.7 | 75.4 | 7,819,200 | 7,776,850 | 880,800 | 11,3 | 8,700,000 | report |

| Auditor General | 9.6 | 0 | 9.6 | 1,074,900 | 996,151 | 65,900 | 6.1 | 1,140,800 | report |

| Fiscal Services | -473,760,400 | -473,760,400 | -34,292,900 | -7.2 | -508,053,300 | report | |||

| Finance, Asset Management, ICT | 329.3 | -3.0 | 326.3 | 37,864,100 | 37,660,711 | 5,324,200 | 14.1 | 6,147,200 | report |

| Corporate and Customer Services | 229.8 | 0.2 | 230.0 | 36,996,800 | 37,003,800 | 4,519,900 | 12.2 | 41,516,700 | report |

| Halifax Regional Police | 804.4 | - | 804.4 | 96,757,000 | 96,204,000 | 2,454,400 | 2.5 | 99,211,400 | report |

| RCMP | 184.0 | - | 184.0 | 27,864,000 | 27,864,000 | 1,555,000 | 5.6 | 29,419,000 | Same as HRP |

| Halifax Public Libraries | 336.0 | - | 336.0 | 27,663,200 | 27,366,800 | 1,467,700 | 5.3 | 29,130,900 | report |

| Halifax Regional Fire & Emergency | 536.5 | 13.5 | 550.0 | 71,368,700 | 71,874,700 | 5,505,300 | 7.7 | 76,874,000 | report |

| Halifax Transit | 1,046.5 | 20.1 | 1,066.6 | 107,629,900 | 109,034,400 | 9,879,800 | 9.2 | 117,509,700 | report |

| Transportation and Public Works (TPW) | 348.2 | 10.4 | 358.6 | 100,408,800 | 99,836,400 | 7,850,500 | 7.8 | 108,259,300 | report |

| Parks & Recreation | 479.1 | -0.2 | 478.9 | 38,830,200 | 43,945,900 | 3,852,600 | 9.9 | 42,682,800 | report |

| Planning & Development | 224.7 | 2.1 | 226.8 | 20,691,400 | 19,200,300 | 3,696,800 | 17.9 | 24,388,200 | report |

| Total | 180.6 | 17.7 | 198.3 | 23,399,700 | 23,454,780 | 3,485,800 | -5.6 | 26,885,500 |

Legend

- 2020/21 staff – shows how many FTEs (full time equivalents) this department budgeted for in 2020/21

- 2021/22 request – shows how many new FTEs the department has requested for 2021/22

- 2021/22 staff – shows the total number of FTEs for 2021/22

- 2020/21 budget – shows the budgeted operating expenses for the department

- 2020/21 projection – shows how much the department expects to spend by Mar 31, 2021

- 2021/22 request – shows the requested increase for 2021/22

- % change – shows how much the 2021/22 request is over the 2020/21 projection

- 2021/22 budget – shows the budgeted operating expenses for the department

Budget Adjustment List (Overs and Unders)

As the budget is being discussed, we will look at items that aren’t in the base department budgets. These are referred to as “overs” where expenses are increased or “unders” where expenses are decreased. We develop this list as we review the budgets for the different departments, and then put them in the “parking lot” for discussion with the Budget Adjustment List at the end of the process.

These items may be included in the final budget amount or they may not. That decision is only made near the end of the process.

The table below shows the list of overs and unders that we have put in to the parking lot.

| Item | Business Unit | Occurrence | Over or Under | Amount | Tax Bill Change |

|---|---|---|---|---|---|

| Councillor Newsletters | CAO | On-going | Over | $56,000 | $0.19 |

| Anti-Black Racism project | CAO | On-going | Over | $72,500 | $0.25 |

| IT Audit Project | Auditor General | On-going | Over | $71,100 | $0.25 |

| Non-profit tax rebate for affordable housing (25% to 50%) | Finance | On-going | Over | $446,000 | $1,54 |

| Body Worn Video Project Coordinator (12 month term) | Police | One-time | Over | $85,000 | $0.29 |

| Journey to Change Training | Police | On-going | Over | $60,000 | $0.21 |

| Court Disposition Clerk | Police | On-going | Over | $85,800 | $0.30 |

| Library Food Program | Library | On-going | Over | $50,000 | $0.17 |

| Library Electronic Resources | Library | On-going | Over | $100,000 | $0.35 |

| Traffic Calming Budget Increase | TPW | One-time | Over | $1,000,000 | $3.45 |

| Route 55 proposed changes | Transit | On-going | Over | TBD | TBD |

| Reinstatement of some service coverage | Transit | On-going | Over | TBD | TBD |

| Route 415 - additional bus | Transit | On-going | Over | TBD | TBD |

| District 12 service by Park & Ride | Transit | On-going | Over | TBD | TBD |

| Weekly Organics Collection | TPW | On-going | Under | $-850,000 | $-2.94 |

| Weekly Recycling Collection | TPW | On-going | Under | $-850,000 | $-1.07 |

| Household Special Waste events | TPW | On-going | Over | $115,000 | $0.40 |

| Transit Stop Clearing | TPW | On-going | Over | $2,000,000 | $6.91 |

| Non-Accepted Streets | TPW | One-Time | Over | $400,000 | $1.38 |

| COVID Event Grant and Recovery Program | Parks & Rec | One-time | Over | $750,000 | $2.59 |

| Discover Halifax | Parks & Rec | One-time | Over | $250,000 | $0.86 |

| MDF Subsidy Request | Parks & Rec | One-time | Over | $1,757,350 | $6.07 |

| Queen's Marque - Public Art | Parks & Rec | One-Time | Over | $125,000 | $0.43 |

| Multi-Service Youth Centre ("The Den") | Parks & Rec | On-going | Over | $85,000 | $0.29 |

| E.coli microbial analysis on First Lake | Planning | One-time | Over | $150,000 | $0.52 |

| Heritage Conservation District funding | Planning | On-going | Over | $250,000 | $0.86 |

| Planning positions (10 new positions) | Planning | On-going | Over | $805,300 | $2.78 |

| In-year staffing requirements | CAO | On-going | Over | $2,250,000 | $7.77 |

| Urban Forestry Plan to 75% | TPW | One-time | Capital | $1,315,000 | $4.54 |

| Total | $11,120,550 | $38.41 |